Mileage Reimbursement 2025 Form - Washington State Mileage Reimbursement Rate 2025 Filide Sybila, Current mileage reimbursement rate 2025 ohio. The standard mileage rates for 2025 are as follows: Va travel pay reimbursement through the beneficiary travel program pays veterans back for mileage and other travel expenses to and from approved health care.

Washington State Mileage Reimbursement Rate 2025 Filide Sybila, Current mileage reimbursement rate 2025 ohio. The standard mileage rates for 2025 are as follows:

Free Printable Mileage Reimbursement Form Printable Forms Free Online, Effective january 1, 2025, the mileage reimbursement rate changed from 65.5 cents to 67 cents per mile as directed by internal revenue service (irs). Best websites for booking cheap flights of 2025.

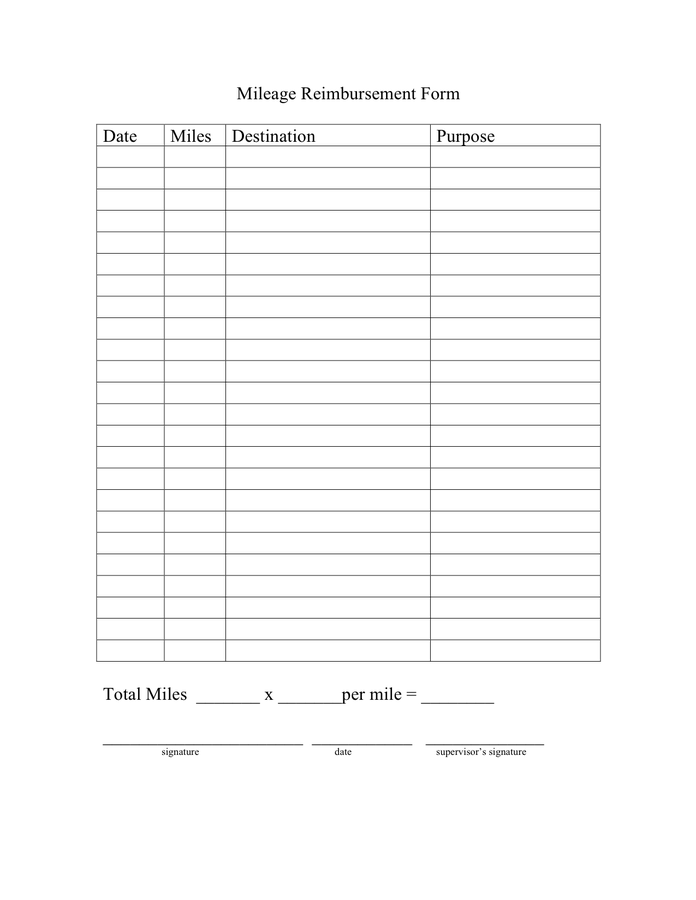

Printable Mileage Reimbursement Form Printable Form 2025, The standard mileage rates for 2025 are as follows: Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use.

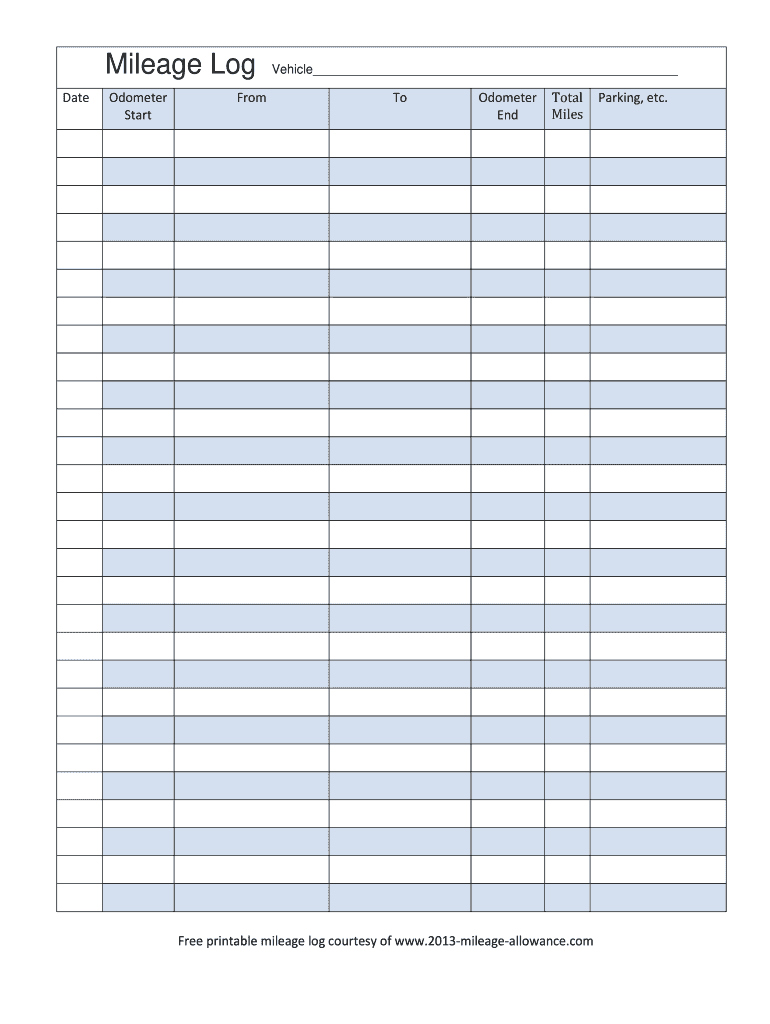

Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates.

Mileage Reimbursement Form in PDF (Basic), Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates. According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs of operating an automobile.” here are the mileage rates for the year 2025:

As the name suggests, reimbursements. Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates.

2025 Car Mileage Reimbursement Rate Mandy Rozelle, The 2025 mileage reimbursement rates for gsa is based on the annual irs mileage rates. According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs of operating an automobile.” here are the mileage rates for the year 2025:

Mileage Reimbursement Rate 2025 Shirl Marielle, You may also be interested in. Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use.

Mileage Reimbursement Form in Excel (Basic), Best for onekey rewards members (star. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving.

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel, Best websites for booking cheap flights of 2025. New standard mileage rates are:

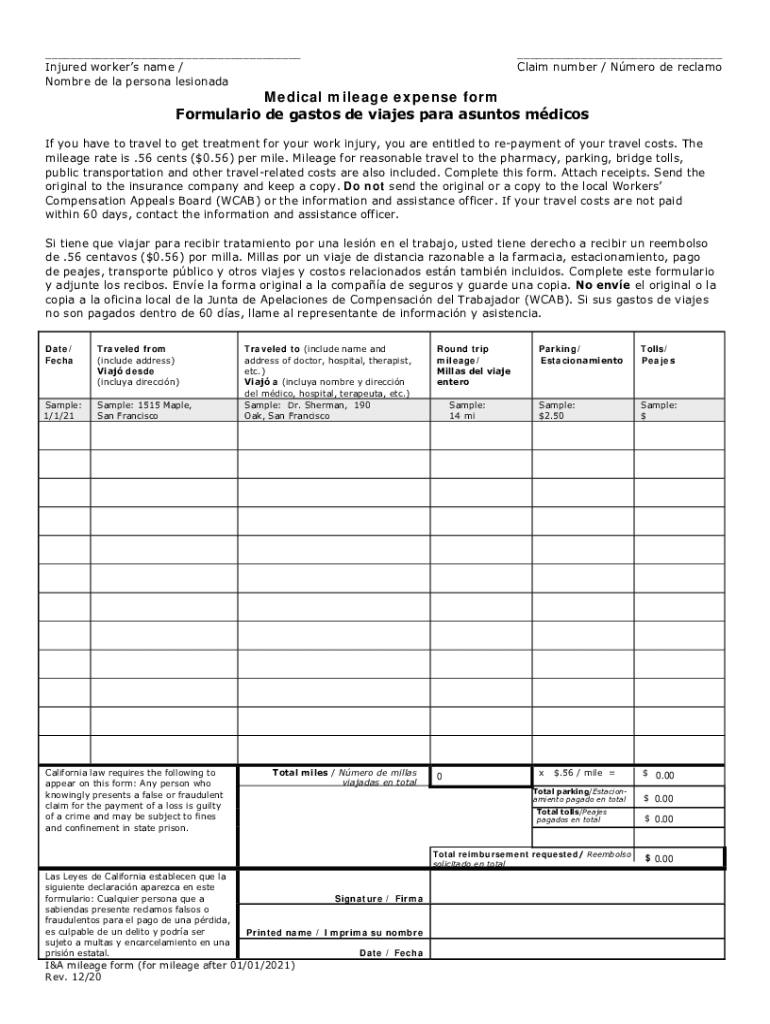

If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’.